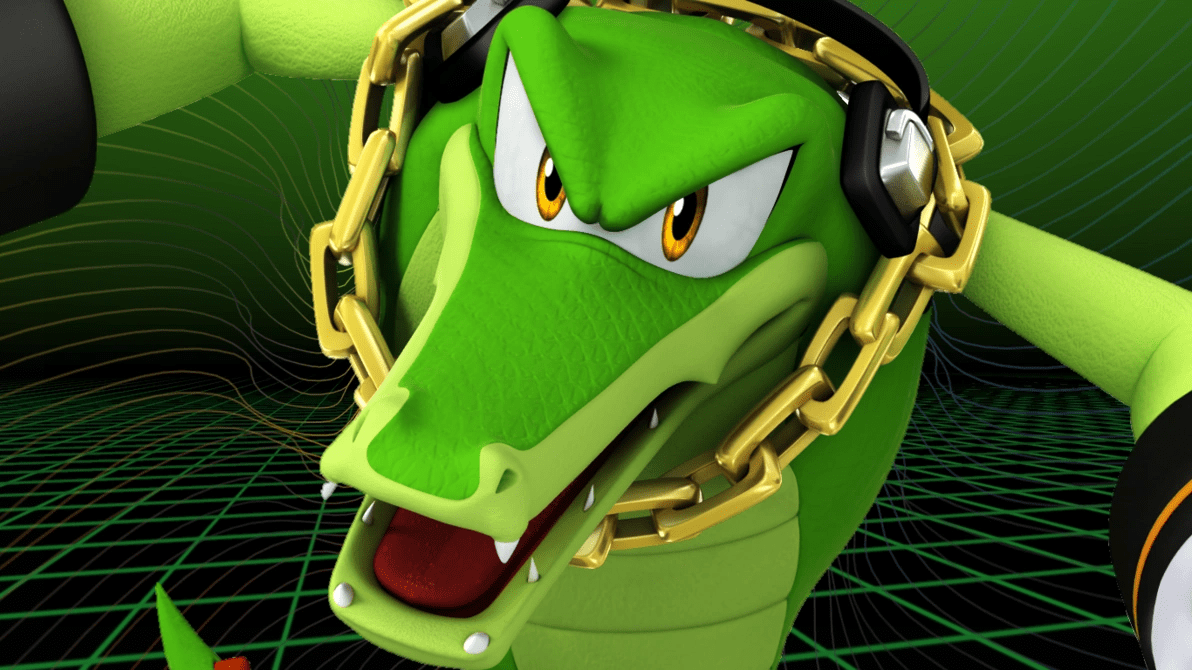

What Experts Are Saying About Vector The Crocodile 2014 02 Sonic Channel 20052022 Gallery

Agreement for avoidance of double taxation and prevention of fiscal evasion with albania the government of the republic of india with. It allows all taxpayers to reduce the tax implications of their income earned in. Dtaa ensures that taxpayers can avoid international tax burdens and pay taxes in both countries.

Vector The Crocodile Plush

According to the agreement, an individual earning an income in another country while being a resident of another country does not have to pay two (double) taxes on the same. There are two exemption methods to claim benefits under dtaa: Taxpayers must disclose their foreign income and claim dtaa benefits in their tax returns.

Under this method, tax relief can be claimed in the country of residence.

Raise awareness about the consequences of. For taxability of an nr, who comes from a country outside india with which india has entered into a dtaa, the provisions of the it act apply only to the extent that they are. In some cases, they may need to submit additional documentation, such as proof of. The taxpayers guide to claim exemptions/deductions encourage employees to file correct and complete income taxreturns.