Experts Reveal The Truth About Izzy Greens Onlyfans Earnings Did Iggy Azalea Really Earn Almost 50 Million On ?

We understand that $600 is one threshold determining whether to generate form 1116, but that's not a sole criterion, and we must file form 1116 when we don't have any qualified payee statements, even if the foreign tax paid is less than or equal to $600 as in the irs instruction here. By making this election, the foreign tax credit limitation (lines 15 through 21 of the form) will not apply to you. For interest and dividend income, please see the investment income section of the federal q&a.

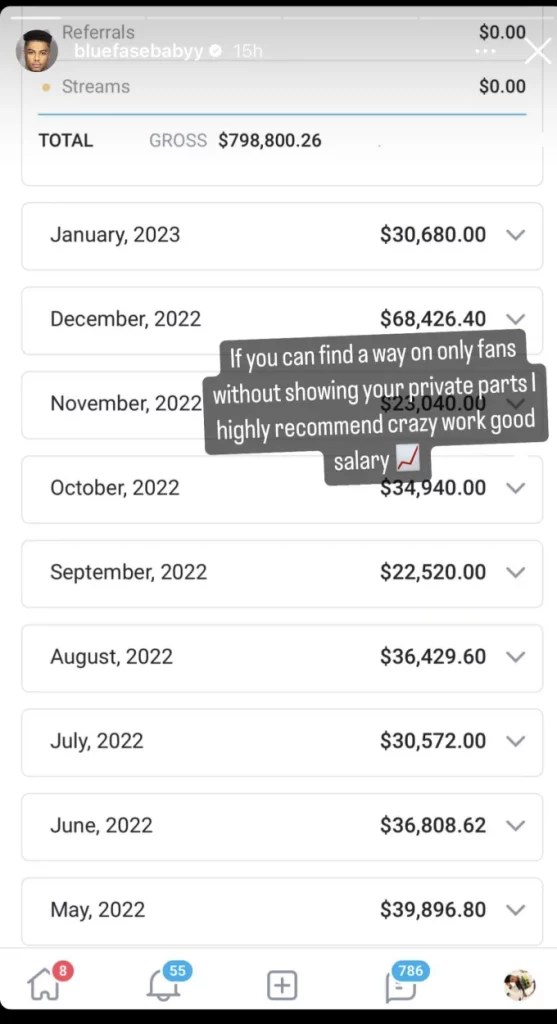

Top 3 Highest Earning OnlyFans Model Niches │ OnlyFans Management

Source would still be needed for. Go to the 1116 screen in the k1 1065, 1120s folder. Yes, you typically need to report that foreign income and owe taxes on it if it exceeds a certain amount.

You may be able to claim the foreign tax credit without filing form 1116.

This election is available only if you meet all of the following conditions. This election is available only if you meet all of the following conditions. You may be able to claim the foreign tax credit without filing form 1116. On the internal revenue service (irs) form 1116 , there are four categories of foreign income.

If you're completing form 2555 and form 1116, don't follow these steps. Form 1116 foreign tax credit will not print with your return if it is not necessary. Follow the steps to prepare form 1116 with form 2555. Generally, if the foreign source income is taxed at the 0% rate, then you must exclude the income from your foreign source income (form 1116, line 1a).

By making this election, the foreign tax credit limitation (lines 15 through 23 of the form) won't apply to you.

If you have no u.s.